Thinking of becoming a payroll specialist with a background in accounting? As a payroll administrator, your job is to make sure that people get their deserved salaries on time. Your affinity with numbers and attention to detail can be the major capital in the job market for payroll positions. With your expertise in accounting, you are looking at a higher salary and key position where ethics is one of the most crucial elements.

Table of Contents

If you have an eye for detail, basic office management skills and good numeracy skills, you can be an ideal candidate for the job. You have to handle sensitive information about the employees’ salary and banking details. Naturally, you are required to be honest and discrete in your job as a payroll administrator.

You can work for the finance team of an organization as a payroll manager. There are financial establishments that provide payroll services to many other companies. The opportunities are incalculable as organizations from different sectors hire payroll specialists.

How much will you earn as a payroll specialist?

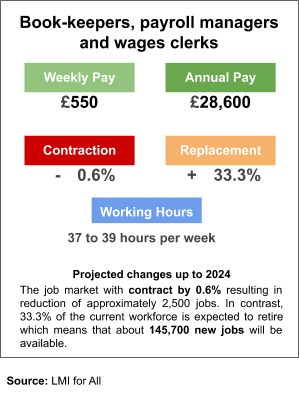

According to the estimates of National Careers Service, the average salary for the payroll clerks is between £15,000 and £28,000 per annum based on your experience. With a degree in accounting, you are looking at a higher grade.

The general duties of a payroll administrator

As a payroll administrator, you work to meet a strict deadline for processing all the payments on time accurately. Your typical responsibilities are:

- Logging the working hours of employees

- Calculating the amount of payment for individual employees

- Issuing cheques, making electronic transfers according to the calculations

- Processing additional payments in the form of holiday, sick and maternity pay

- Issuing P45s and other required tax forms

- Replying to staff queries relevant to timesheets and payslips

- Adjusting payments for overtime, tax cuts, pension, national insurance

- General administrative responsibilities like filing, documenting, software inputs, report generating.

Prerequisites for becoming a payroll assistant

You need to highlight some essential skills in your job application for payroll administrator or payroll clerk positions:

- Experience in administrative posts in any office/ administrative skills in other sectors

- Showcase your comfort level with numbers and your attention to detail

- IT skills to complement your expertise with numbers and documentations

- Good communication and presentation skills in presenting data and reports

Relevant work experience and accredited certifications in MS Office can boost your CV for the payroll management roles.

Path to the career of a payroll administrator

There are a few options for you if you are planning to start your career as a payroll administrator.

1. College courses

With an introductory course in bookkeeping and payroll, you can achieve your qualifications for payroll positions. You can do the courses offline or enrol in a distant learning course. The fundamental courses include Foundation Certificate in Bookkeeping, Level 1 Certificate in Payroll, Level 1 or 2 Certificate in Bookkeeping. The entry requirement varies depending on the institution.

2. Apprenticeships

If you are thinking of an advanced apprenticeship for a payroll administrator position, you will require 5 GCSEs at grades 9 – 4 (A* – C) or equivalent qualification. English and maths are mandatory for payroll positions.

3. Direct applications

You can directly apply for jobs with the same qualifications for apprenticeship jobs. Experience in relevant fields like accounting and bookkeeping will be helpful in your job search.

4. Qualifications by professional bodies

You can choose the qualifications provided by The Chartered Institute of Payroll Professionals for better opportunities in the field. The courses vary for different levels.

In the beginning, you can look for positions like payroll clerk, payroll administrator, payroll apprentice, payroll trainee, payroll assistant, payroll coordinator. Once you gain experience in the field, you can advance to payroll supervisor or manager positions.

Required qualifications for payroll supervisor positions

If you have a degree in accounting or you are working in a bookkeeping position, you might want systematic training to become a payroll specialist. From our course on payroll management, you will get insights into the requirements for the job:

- The definition of payroll and the principles of payroll systems

- Security and confidentiality in payroll management

- How to increase the efficiency of payroll management

- About addressing risks and managing time.

With the basic understanding of payroll administration, you are ready for the qualifications with The International Association of Book-keepers (IAB) or The Association of Accounting Technicians (AAT).

Apprenticeships and internships are abundant in this job category. You can work and study towards qualifications like:

- Certificate in payroll administration

- Certificate and diploma in payroll or computerised payroll

- National payroll certificate

As a payroll specialist, you are qualified to work for different types of organizations and businesses in the public and private sectors. However, you will succeed rapidly if you are experienced in accounting and bookkeeping.

Softwares used in Payroll Management

Tor Marie, in her pitch on payroll management software, lists the following payroll management software which are popular in the UK:

- HMRC Basic PAYE Tools: A basic PAYE tool provided by the government for a business with a maximum of 9 employees. You can manage your tax and national insurance, send payment summaries and check the NINO for new employees.

- Sage Payroll: Being the 3rd largest business software provider located in Newcastle-upon-Tyne, Sage allows you to create payslips, generate hourly payments. With the software, you can manage bonuses and holiday payments, student loan payments and national insurance subtractions.

- Xero Payroll: Xero is one of the popular cloud-based accounting solutions that started operations in the UK in 2008. The key features of the software include flexible pay calendars, encrypted electronic payslips, pension filings. You can submit payroll data directly to HMRC using Xero.

- Intuit Payroll: Intuit QuickBooks Payroll works alongside QuickBooks to handle all the major function of payroll management. The software covers tax, pension, national insurance (NI), payslips. It also sends real-time data to HMRC to make life easy for you. More importantly, the software package comes with a free mobile app that allows you to store receipts as pictures on the application.

- KashFlow Payroll: Another cloud-based accounting software that comes with bookkeeping, HR and payroll in a bundle. The software can help you to automate payroll approval, give employees access to payslips, generate payroll updates in realtime.

- BrightPay: With over 100,000 employers in Britain as clients, the software delivers high customer satisfaction rate. The software can assess your employees for you and prompt you to make decisions. Direct API integration with pension providers is a key feature of the product.

- FreeAgent: A balanced bookkeeping and account solution that covers payroll management as a component. You can create weekly or monthly payslips, create P60s using FreeAgent. The mobile app for the software provides a range of helpful features for the clients.

- Reio: A software that tries to minimize your efforts of employee management to a great extent. It handles payroll calculations, HMRC submission, basic HR functions. Another important feature of the software is the integration options with popular platforms like Google Suite and Xero.

- IRIS Payroll: IRIS has an impressive track record of 35 years with over 3 million British businesses that use the software for tax returns. It provides free updates.

- Fourth: A workforce management software specifically designed for the hospitality industry. You can manage payroll, service charge allocation, scheduling and demand using the software.

With multi-function software, you can build your career as a payroll specialist more effectively. However, to progress from your existing payroll administrator positions, you need certification. With our payroll management diploma, you are in with a chance for rapid professional development with CPD accreditation.